With COVID-19 spreading rapidly across the United States and the world, our lives have temporarily changed both health-wise and economically.

While the real estate market at the moment seems relatively unscathed, will it remain like that?

A key issue facing the U.S. real estate market besides falling stock prices, social distancing, and financial uncertainty, is the effect low oil prices could have on home values.

In this article, we’re going to cover the correlation between oil prices and real estate and how the coronavirus has played a role in the ongoing oil production war between Saudi Arabia and Russia.

Let’s dive in.

The Situation

Once it became clear that the coronavirus wasn’t going away anytime soon, the members of OPEC (Organization of the Petroleum Exporting Countries), led by Saudi Arabia, came together to discuss the oil strategy they would take to combat the financial effects of the virus.

OPEC agreed to cut oil production down by about 1.5 million barrels per day. This would ensure that oil prices remain at a profitable level while COVID-19 spreads.

Russia, being loosely entangled with OPEC, was supposed to sign off on the deal.

This is when everything fell apart.

Russia, in order to prevent U.S. shale oil companies from gaining market share, announced that they would not abide by the agreement and stated that as of April 1st, they would remove their restrictions on oil production to compete with U.S. companies.

This led Saudi Arabia and OPEC to a full reversal in their position. Saudi Arabia announced that they would start producing an additional 10 million barrels per day and grant price cuts to their most preferred customers, essentially launching a price war with Russia.

The problems with this:

- Oil markets are already near capacity and now it’s being flooded with more oil.

- The travel industry is being affected the most by coronavirus and people are staying home to prevent the spread of the virus, drastically lowering oil consumption.

- Lower consumption = lower demand = lower prices = little-to-no profits.

So how does this affect the real estate market?

The Domino Effect of Oil

Oil doesn’t directly affect the real estate market, but it does create a chain reaction that can eventually reach the real estate market over a period of time.

Here’s how.

The United States is the largest oil producer in the world as of the coronavirus outbreak. When global oil prices drop, the U.S. must follow suit to stay competitive.

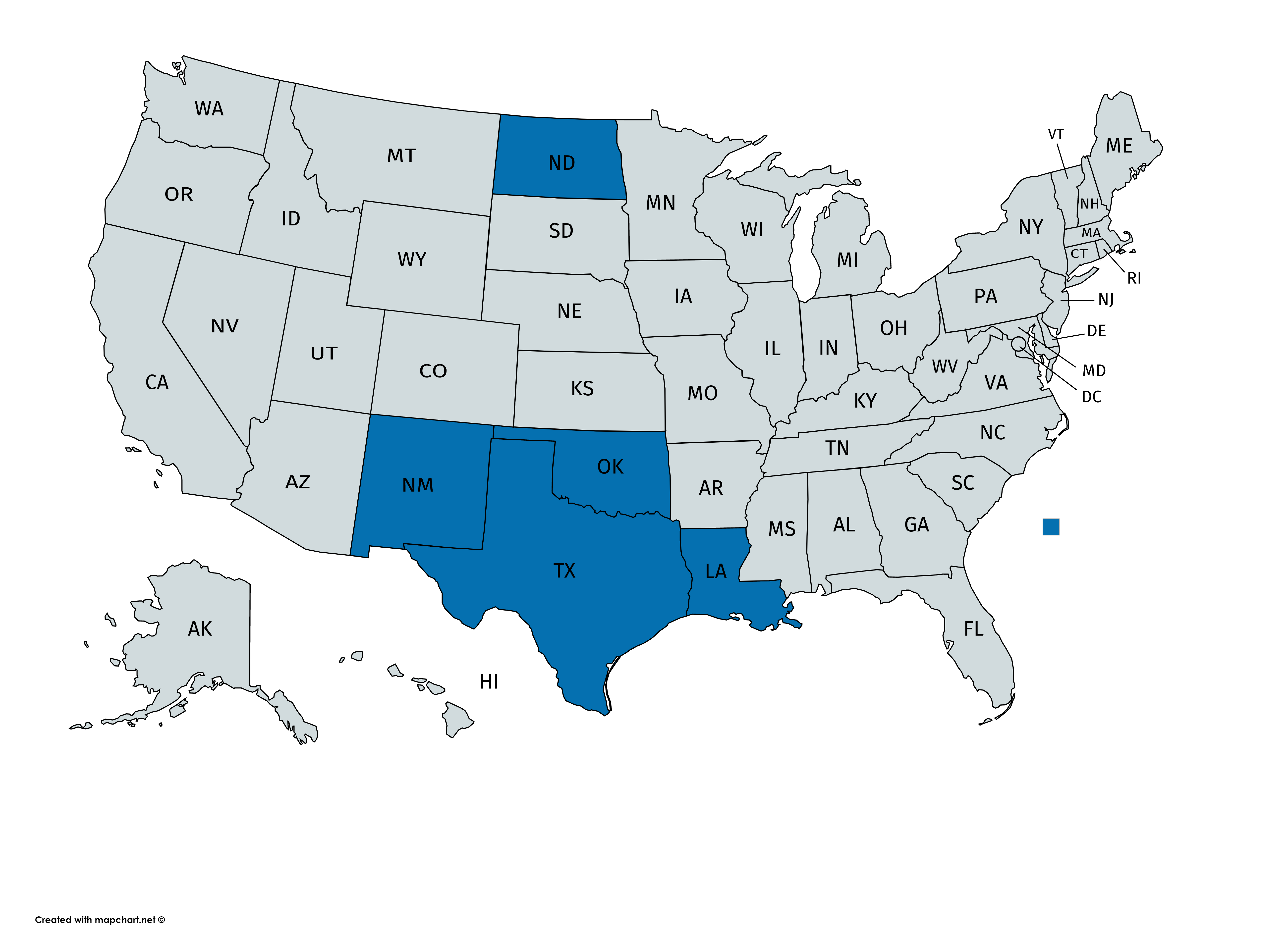

This causes oil companies in the United States, primarily located in Texas, Louisiana, Oklahoma, New Mexico, and North Dakota, to lose profits. When companies lose profits, they must reduce the number of employees they have.

This means layoffs. Layoffs are not good for any economy.

With fewer employees, oil companies lower the volume of supply purchases to stay in the green. This hurts the supply companies that provide the material, which include PVC piping, steel, plastics, etc.

Once the supply companies start to lose profits, another round of layoffs follow, and the cycle continues.

When Does This Affect Real Estate?

Once companies entangled in the energy industry begin laying off employees to consolidate cash flow, the unemployment rate rises, and people begin to panic. Especially the ones who have mortgage payments.

If those unemployed persons can’t find a job in time to alleviate their financial burdens, their mortgage and other bills begin to stack up against them and suddenly they’ve defaulted on their loan.

Keep in mind, this process takes a lot of time. Real estate is considered a safer investment due to the lack of volatility in the market.

But, regardless, one foreclosure can affect a neighborhood’s value, and when you have states like Texas employing over 338,000 fuel-related employees. You may begin to see a serious uptick in foreclosures within certain areas.

When that happens, property values decline because foreclosures are usually sold at a lower price, also known as a “short sale.”

Due to comparable property data being the number one determinant of pricing—property values sink—and people start to lose out on their equity.

Millions of dollars in wealth can be lost over the course of about half a year.

Who Will Be Affected?

The pertinent question is wondering who could be affected by falling oil prices.

Obviously, the states relying on energy production will get hit the hardest. The map below shows the states with the highest oil production.

But due to real estate being hyper-focused on certain communities, it’s important to examine what particular areas could suffer the most.

Big Cities vs. Small Towns

Large urban areas with a major oil industry will certainly be affected by lower housing prices due to an oil bust, but how much?

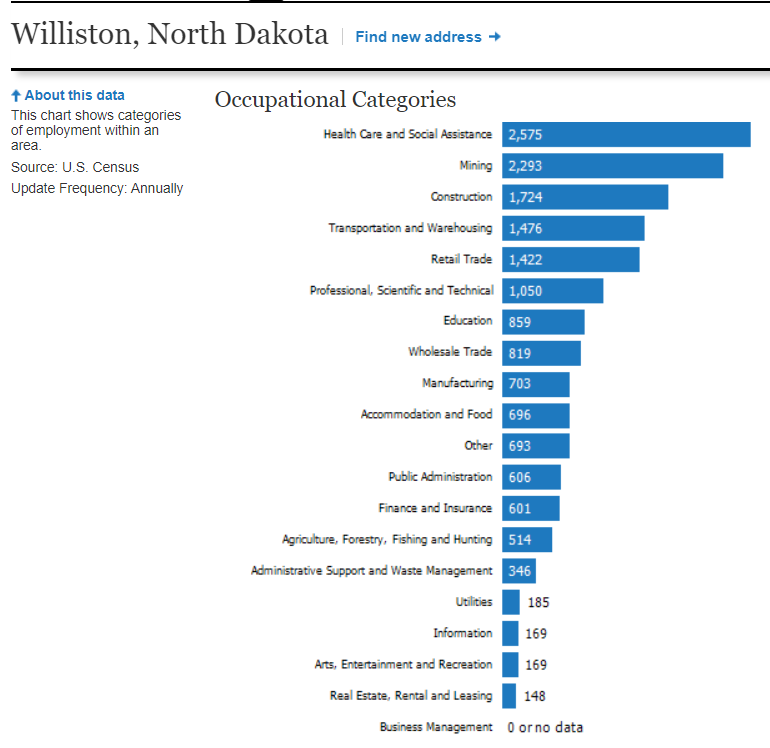

If we look at Houston, Texas, one of the larger oil-producing cities in America, you would expect them to get hurt by an oil bust. But if we look further at their job market, we see a different story.

From the chart, we can clearly see that Houston has a diversified job market. If any of the labor forces were to cripple, there are plenty of other industries to keep things stable, thus protecting real estate from a full-on crash.

However, smaller towns that rely on oil production to fuel their economy could have serious problems.

Related: The Impact of Coronavirus on Real Estate Markets

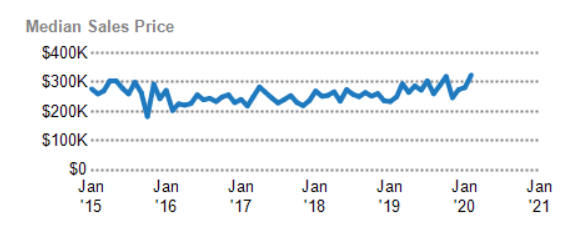

For this example, we’ll examine Williston, North Dakota. Back in 2010, Williston was home to a massive oil boom. People flocked to the small city from all around the country to take a slice of the huge profits oil companies were making.

But since 2015, oil production has slowed down in Williston, and economic stagnation followed. The housing market has hardly appreciated in the last couple of years.

Furthermore, the oil industry, which once comprised a third of the labor market, is no longer the chief employer.

All the people who moved to Williston in search of a better opportunity with oil bought homes that are no longer appreciating, or in fact, are losing equity. They’re also finding themselves working in a different industry due to layoffs in oil.

With oil prices dipping even further and the coronavirus causing mass panic, Williston could be in for a bad year.

How to Protect Yourself as an Investor

If you invest in real estate, then you probably know that diversification is key.

When purchasing properties, renting out to tenants, and flipping homes, it’s crucial to look beyond the real estate statistics in terms of appreciation over time, listing volume, and median sales price.

Look at the greater economic picture. Ask yourself questions like:

- Does this community have a diversified labor market?

- What is the primary source of income for this region?

- Do I see any potential economic fallouts due to speculation or over-reliance on a particular industry?

Play your cards the way you see fit—but use data to make informed decisions.

Final Thoughts

How far the coronavirus takes this oil price war is unknown. There isn’t much information or data available to give us an idea on the time it will take to fight this virus and bring stability back to the world.

But until then, I don’t see oil prices changing from their current trajectory anytime soon.

Hopefully, we use this strange time in our history to recognize the underlying issues with our decisions, economic principles, and awareness for unknown possibilities.

My main piece of advice: Wash your hands and be safe.

Read original article here: https://www.biggerpockets.com/blog/coronavirus-harm-real-estate-market-oil-price-war